Atlas Energy

From Wikimarcellus

| Revision as of 18:56, 28 September 2008 Tcopley (Talk | contribs) ← Previous diff |

Current revision Tcopley (Talk | contribs) (Greg Hild is a Chevron Corp. geologist.) |

||

| Line 1: | Line 1: | ||

| - | Here is where some info about '''Atlas Energy''' should go. | + | Moon Township, [[Pennsylvania]]-based Atlas Energy, Inc. (ATLS) (Pittsburgh metro area) superseded and merged a subsidiary of ''Atlas America, Inc.'' and ''Atlas Energy LLC'' and effective September, 2009 became the surviving entity. As of February, 2010 it controlled approximately 584,000 acres prospective for [[Marcellus shale]] with over half of the acreage outside of its traditional southwestern Pennsylvania territory. Its leasehold was located in Pennsylvania, [[West Virginia]] and [[New York]]. The company had been organized similar to a limited partnership run by the parent company, ATLS. The later, also had another subsidiary, ''Atlas Pipeline Partners (APL)'', which owned and operated a network of gas pipelines that hooked-up to interstate pipelines. In November, 2010 the company announced that it had been acquired by ''Chevron Corporation'' for $4.3 billion including the assumption of its outstanding debt. The deal closed in February, 2011. |

| - | This article is still a stub and needs your attention. It does | + | |

| - | not have a template and contains minimal information. Please dive | + | |

| - | in and help it grow! | + | |

| - | '''Atlas Energy LLC''' (ATN), based in Moon Township, PA (Pittsburgh metro area), is a subsidiary of '''Atlas America, Inc.''' (ATLS). It owns all of the production assets of the parent company which are substantially located in the Appalachian Basin. A September, 2008 report stated that Atlas had 78 vertical Marcellus shale wells and one horizontal one. 69 wells were feeding into a pipeline. | + | ===Latest Operating Results=== |

| - | Atlas was reported in September, 2008 to be an investor along with [[CONSOL Energy Company]] of approximately $100 million in the western Pennsylvania counties of Westmoreland and Allegheny. | + | According to a May, 2010 Atlas update, since the inception of its horizontal drilling program during the first quarter of 2009, the company had spud 42 horizontal wells in the core [[Marcellus shale]] area of southwestern Pennsylvania. 29 of these had been drilled and cased. Another 13 were still drilling. 17 were producing to sales--6 in the wet gas area and 11 dry gas. Of the dry ones, 7 were landed low in the Marcellus shale section. The latter ones were strong producers averaging 5 Mmcf/d of initial production into a pipeline. The company expected these to average 2 Mmcf/d in the first year. The decline curves for these wells exceeded management's expectations indicating greater estimated ultimate recovery (EUR) than earlier predicted. |

| - | It is organized similar to a limited partnership run by the parent company, ATLS. The later, also has another subsidiary, Atlas Pipeline Partners (APL), which owns and operates a network of gas pipelines. | + | ===2008 to 2009 Timeline=== |

| + | |||

| + | A September, 2008 report stated that Atlas had 78 vertical Marcellus shale wells drilled and one [[Horizontal drilling|horizontal]] one. 69 of these fed into pipeline. By year-end 2009, the company was reporting a total of 17 horizontal wells had been drilled during the year. 10 of these had been completed and were online to sales. | ||

| + | |||

| + | Atlas was reported in September, 2008 to be an investor along with [[Consol|CONSOL Energy Company]] of approximately $100 million in the western Pennsylvania counties of [[Westmoreland]] and Allegheny. | ||

| + | |||

| + | According to an October, 2008 report, Atlas owned drilling rights to roughly 587,000 acres of Pennsylvania Marcellus shale, and had invested in excess of $50 million. 271,000 acres were in southwestern [[Pennsylvania]] and mostly acquired during 2007 to 2008. '''''Update #1:''''' August, 2009. Atlas' second quarter, 2009 report issued in early August indicated that the company now owned 532,000 acres prospective for Marcellus shale, and 266,000 acres of it is located in southwest Pennsylvania. '''''Update #2:''''' A February, 2010 company update modified the above by designating an additional 44,000 acres as prospective for Marcellus shale thus bringing Atlas' grade A southwestern Pennsylvania acreage up to 314,000 acres. | ||

| + | |||

| + | ====Horizontal drilling program gets underway in Washington Co.==== | ||

| + | |||

| + | In early November, 2008 drilling on the horizontal leg of the company's second horizontal well had begun, and it was expected to be completed and online by year-end. Atlas announced in late November, that it had finished drilling and casing the well. It was located in [[Washington|Washington County]] and extended horizontally 3,000 feet. The company planned an eight-stage frac for it. In May, 2009 Atlas announced a third horizontal well in the series had the extraordinary initial production rate (IP) of 10.1 Mmcf/d. By mid-May, eight horizontal wells had been drilled since the forth quarter of 2008. Only the first three of those eight were on line. Atlas planned to drill twelve more Marcellus wells by year-end 2009 working with its various joint venture partners. | ||

| + | |||

| + | The company owned a 50% interest in the already-drilled wells as well as the twelve horizontal ones that were planned with partners. Ten of these were located in Washington County, Pa. The remaining ones were to be drilled in eastern Greene and western Fayette counties. Atlas was slated to operate the latter two and have a 25% working interest in them. | ||

| + | |||

| + | Another November, 2008 report indicated that at the time, Atlas had 90 Marcellus shale wells producing 25 Mmcf/d. | ||

| + | |||

| + | In December, 2008 the company announced that one of its vertical Marcellus shale wells had an estimated initial production of 5 Mmcf/d. While the location of this spectacular vertical well was not provided, the same company update noted that Atlas had completed over 100 vertical wells in its Marcellus drilling program. | ||

| + | |||

| + | ====Laurel Mountain Midstream LLC joint venture==== | ||

| + | |||

| + | In April, 2009 APL announced that it had become 49% owner of a [[Laurel Mountain Midstream LLC|joint venture]] with [[Williams Transco|The Williams Companies]] in which substantially all of its Appalachian pipeline gathering system had been transferred to it. | ||

| + | |||

| + | ====Drilling program unfolds in 2009==== | ||

| + | |||

| + | Atlas was reported to be actively leasing drilling rights in Fayette, Greene, [[Washington]] and Westmoreland Counties in Pennsylvania. | ||

| + | |||

| + | Atlas' second quarter, 2009 report stated that the company had drilled 19 vertical and two horizontal wells in the quarter. It had completed one of the two horizontal ones. | ||

| + | |||

| + | The company planned to drill and complete roughly 100 vertical and 4 horizontal Marcellus shale wells before the end of 2009. The horizontal wells were to be 100% owned by Atlas. | ||

| + | |||

| + | According to a July, 2009 report, Atlas had about 75 people working in its Moon Township Headquarters and another 200 in its Fayette County Field Office in Smithfield, PA. | ||

| + | |||

| + | ====Horizontal drilling starts to pay off==== | ||

| + | |||

| + | In November, 2009 Atlas reported that it had drilled two horizontal wells in southwestern Pennsylvania: | ||

| + | # one in western Fayette County - 3.3 million Mmcf/d average for 30 days | ||

| + | # another in eastern Greene County - 3.5 million Mmcf/d average. | ||

| + | The first well had shown virtually no decline after 40 days, and the second Greene Co. one had shown similar stable or flat performance. During the first 3 quarters of 2009, the company had drilled 14 horizontal wells. 4 were online and producing, whereas of the remaining 10 wells one was flowing but awaiting connection, three were shut-in behind a processing plant upgrade, and six were awaiting fracs. These are to be placed online during the final quarter of 2009 or in 2010. Some of these wells are in the company's partnership program or else were drilled in partnership with other companies and are not owed outright. However, in 2010, Atlas planned to drill and complete 30 horizontal [[Marcellus shale]] wells on its own account. | ||

| + | |||

| + | ====Atlas' metamorphosis into a full E & P company==== | ||

| + | |||

| + | A year-end 2009 Atlas update in late February, 2010 emphasized that the company had been undergoing a transformation from a master partnership that maximized cash distributions to limited partners to that of a more full E & P company with a specific focus on the [[Marcellus shale|Marcellus]] and other shale formations. The shifting emphasis had involved organizational and staff changes as well as general curtailment of shallow drilling activities. At the time of this report, Marcellus production amounted to 60 Mmcf/d (gross) and 15 Mmcf/d (net) and this volume was on the increase. | ||

| + | |||

| + | ===2010 Timeline=== | ||

| + | |||

| + | The company continued to upgrade its pipeline and gas processing capacity to accommodate the future growth in production expected. It planned to drill 28 Marcellus wells that were 100% owened during 2010. All of its wells during 2009 had been drilled with limited partners. | ||

| + | |||

| + | ====New drilling strategy==== | ||

| + | |||

| + | The February, 2010 update also mentioned that Atlas had been using a drilling strategy of landing wells in the lower portion of the Marcellus formation in order to maximize exposure of [[Hydro-fracturing|fracs]] to the rich deposits of organic material that have highest productivity. By landing low, fracs were allowed to climb upwards into the part of the formation with best pay. According to Atlas' [[Microseismic evaluation|microseismic survey]], the best intervals to frac are in the ''Anadarko limestone'' just below the Marcellus shale formation and in the ''Tully limestone'' that sits above the ''Hamilton group''--right above the Marcellus formation. The company's microseismic logs indicated that its wells were draining a 350 foot section that was about evenly divided between the Hamilton group and the Marcellus shale. The company was estimating that the fully loaded cost of drilling a well at approximately $4.2 million, although it was experiencing improved economics through an experience factor and cost was expected to decline to $3.75 million through: | ||

| + | # greater use of [[Pad drilling|pad drilling]] | ||

| + | # more specifically targeted completions | ||

| + | # greater reuse (100%) of [[Waste water|waste water]] | ||

| + | |||

| + | ====Reliance Industries joint venture==== | ||

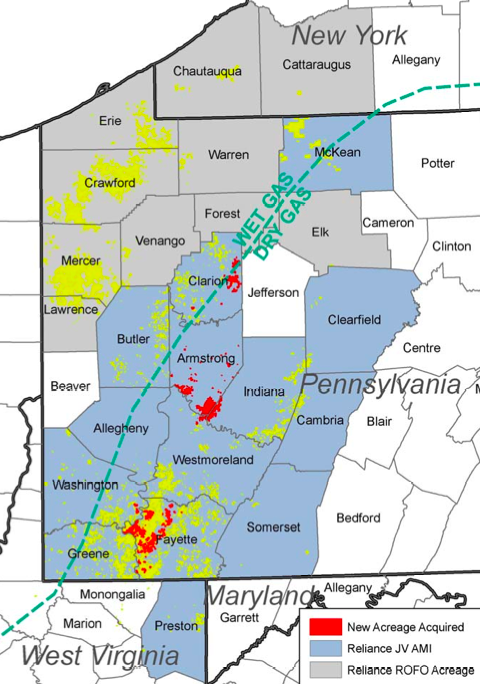

| + | [[Image:atlas_map.png|frame|center|<div align="center">Map depicting boundaries of 2010 Reliance Industries joint venture acreage.<br> Map courtesy of [http://www.atlasenergyresources.com/ Atlas Energy]</div>]] | ||

| + | A joint venture was announced in April, 2010 between Atlas and an Indian energy company, ''Reliance Industries Limited'' (RIL) through its subsidiary, ''Reliance Marcellus LLC''. The latter company acquired 120,000 acres of Atlas' Marcellus acreage mainly in southwestern Pennsylvania. It represented a 40% stake in Atlas' undeveloped leasehold. The deal involved a total of $1.7 billion. $340 million was to be paid up front with a carry of $1.36 billion representing 75% of Atlas' costs for developing its prospective holdings. The carry was to be met within 5 1/2 years with the possibility of renewing for two additional years under certain conditions. Atlas was to be development operator. The JV had the following 5-year drilling plans: | ||

| + | * 45 horizontal wells for the balance of 2010 | ||

| + | * 108 wells in 2011 | ||

| + | * 178 wells in 2012 | ||

| + | * 300 wells in 2013 | ||

| + | * 300 wells in 2014 | ||

| + | Atlas controlled 280,000 additional Appalachian acres not covered by the JV, but should it decide to sell any of this acreage, Reliance retained a right of first refusal to purchase it at $8,000/acre or less. Most of this acreage is in Mercer and Crawford counties among others. | ||

| + | |||

| + | ====Reliance JV picks up more acreage==== | ||

| + | |||

| + | At the end of April, 2010 it was announced that the Atlas - Reliance JV was to purchase an additional 42,344 acres of Marcellus shale primarily located in [[Armstrong]], [[Clarion]], Fayette, Indiana, [[Washington]], and [[Westmoreland]] counties. It had cost the JV an average of $4,532 per acre. This increased the acreage controlled by it to 343,000 acres--206,000 of these were net to Atlas. The JV had closed on April 21, 2010. | ||

| + | |||

| + | ====Westmoreland Co. drilling==== | ||

| + | |||

| + | In June, 2010, Atlas was reported planning to drill a Marcellus shale well off of Hahntown-Wendel Road in North Huntingdon, [[Westmoreland|Westmoreland County]], east of Pittsburgh during the summer of 2010. The well was to be spud on a 9.5 acre parcel in a residential area in the vicininty of Barnes Lake Road. | ||

| + | |||

| + | ====Production rises==== | ||

| + | |||

| + | Net Marcellus shale gas production rose from 20.2 Mmcfe per day by the end of March, 2010 to 33.2 Mmcfe per day at the end of June, 2010, representing a 64% increase. Overall production had been up 10%. During the 2nd. quarter, Atlas had turned 8 horizontal wells into line with average peak production rates above 5.1 Mmcfe/d. The company attributed its good results in part to landing wells in the deeper sections of the Marcellus shale which have been more productive in the company's experience. | ||

| + | |||

| + | ====Fayette Co. drilling==== | ||

| + | |||

| + | The company was reported in July, 2010 applying to drill a Marcellus shale well on land belonging to the ''Connellsville Sportsmen's Association Inc.'' in Bullskin Township, Fayette County, PA. The well required zoning approval from the county hearing board, and the company was being asked to have safety experts testify on its behalf. | ||

| + | |||

| + | ====Enters Utica/Collingwood Shale play==== | ||

| + | |||

| + | Atlas also has a 115,000 gross acre leasehold (70,000 net) in Michigan's emerging [[Utica shale|Utica/Collingwood Shale play]], 83% held by production. The company had acquired 15,000 acres in this play during the first quarter of 2010 for roughly $321/acre. The company planned to drill several wells on this acreage. | ||

| + | |||

| + | ===Spotlight Issues=== | ||

| + | |||

| + | * Prior to its acquisition, Atlas was trending positively in its Marcellus development gaining experience and enjoying decreasing costs. | ||

| + | |||

| + | * As of January, 2011 it is unclear whether Chevron will operate Atlas as a separate corporate entity or else fold it into its own organizational structure. | ||

| + | |||

| + | ===Executive Contacts=== | ||

| + | |||

| + | * Richard D. Weber is President and COO of Atlas Energy. | ||

| + | * Edward E. Cohen, Ph.D. is CEO of the company. | ||

| + | * Matthew A. Jones is the CFO. | ||

| + | * Jeff Kupfer is a Senior Vice President of Atlas. | ||

| + | * Greg Ryan is Senior Vice President of Land. | ||

| + | * Greg Muse is Senior Vice President of Marcellus Operations. | ||

| + | * Tommy L. Thompson is Vice President, Horizontal Drilling. | ||

| + | * Brian Begley is Vice President of Investor Relations. | ||

| + | * Gene Dubay is President and CEO of Atlas Pipeline Partners. | ||

| + | * Brett Loflin is Director of Permitting and Regulatory | ||

| + | Compliance. | ||

| + | * Tim Svarczkopf is Director of Water Management. | ||

| + | * Jim Brauns is an Environmental Regulatory Compliance Officer. | ||

| + | * Bob Hertz and Brett Loflin are spokesmen for Atlas. | ||

| + | * Greg Hild is a Chevron Corp. geologist. | ||

| + | |||

| + | |||

| + | [[Category:E&P Companies]] | ||

| + | [[Category:Active]] [[Category: Regional]] [[Category:Pennsylvania]] [[Category:Northeastern PA]] [[Category:Southwestern PA]] [[Category:Allegheny County]] [[Category:Armstrong County]] [[Category:Clarion County]] [[Category:Indiana County]] [[Category:Greene County]] [[Category:Washington County]] [[Category:Westmoreland County]] [[Category:Marcellus shale]] [[Category:Fayette County]] [[Category:500,000 to 1 million acres]] [[Category:Utica shale]] [[Category:Michigan]] [[Category:Divested All Interest]] | ||

Current revision

Moon Township, Pennsylvania-based Atlas Energy, Inc. (ATLS) (Pittsburgh metro area) superseded and merged a subsidiary of Atlas America, Inc. and Atlas Energy LLC and effective September, 2009 became the surviving entity. As of February, 2010 it controlled approximately 584,000 acres prospective for Marcellus shale with over half of the acreage outside of its traditional southwestern Pennsylvania territory. Its leasehold was located in Pennsylvania, West Virginia and New York. The company had been organized similar to a limited partnership run by the parent company, ATLS. The later, also had another subsidiary, Atlas Pipeline Partners (APL), which owned and operated a network of gas pipelines that hooked-up to interstate pipelines. In November, 2010 the company announced that it had been acquired by Chevron Corporation for $4.3 billion including the assumption of its outstanding debt. The deal closed in February, 2011.

Contents |

Latest Operating Results

According to a May, 2010 Atlas update, since the inception of its horizontal drilling program during the first quarter of 2009, the company had spud 42 horizontal wells in the core Marcellus shale area of southwestern Pennsylvania. 29 of these had been drilled and cased. Another 13 were still drilling. 17 were producing to sales--6 in the wet gas area and 11 dry gas. Of the dry ones, 7 were landed low in the Marcellus shale section. The latter ones were strong producers averaging 5 Mmcf/d of initial production into a pipeline. The company expected these to average 2 Mmcf/d in the first year. The decline curves for these wells exceeded management's expectations indicating greater estimated ultimate recovery (EUR) than earlier predicted.

2008 to 2009 Timeline

A September, 2008 report stated that Atlas had 78 vertical Marcellus shale wells drilled and one horizontal one. 69 of these fed into pipeline. By year-end 2009, the company was reporting a total of 17 horizontal wells had been drilled during the year. 10 of these had been completed and were online to sales.

Atlas was reported in September, 2008 to be an investor along with CONSOL Energy Company of approximately $100 million in the western Pennsylvania counties of Westmoreland and Allegheny.

According to an October, 2008 report, Atlas owned drilling rights to roughly 587,000 acres of Pennsylvania Marcellus shale, and had invested in excess of $50 million. 271,000 acres were in southwestern Pennsylvania and mostly acquired during 2007 to 2008. Update #1: August, 2009. Atlas' second quarter, 2009 report issued in early August indicated that the company now owned 532,000 acres prospective for Marcellus shale, and 266,000 acres of it is located in southwest Pennsylvania. Update #2: A February, 2010 company update modified the above by designating an additional 44,000 acres as prospective for Marcellus shale thus bringing Atlas' grade A southwestern Pennsylvania acreage up to 314,000 acres.

Horizontal drilling program gets underway in Washington Co.

In early November, 2008 drilling on the horizontal leg of the company's second horizontal well had begun, and it was expected to be completed and online by year-end. Atlas announced in late November, that it had finished drilling and casing the well. It was located in Washington County and extended horizontally 3,000 feet. The company planned an eight-stage frac for it. In May, 2009 Atlas announced a third horizontal well in the series had the extraordinary initial production rate (IP) of 10.1 Mmcf/d. By mid-May, eight horizontal wells had been drilled since the forth quarter of 2008. Only the first three of those eight were on line. Atlas planned to drill twelve more Marcellus wells by year-end 2009 working with its various joint venture partners.

The company owned a 50% interest in the already-drilled wells as well as the twelve horizontal ones that were planned with partners. Ten of these were located in Washington County, Pa. The remaining ones were to be drilled in eastern Greene and western Fayette counties. Atlas was slated to operate the latter two and have a 25% working interest in them.

Another November, 2008 report indicated that at the time, Atlas had 90 Marcellus shale wells producing 25 Mmcf/d.

In December, 2008 the company announced that one of its vertical Marcellus shale wells had an estimated initial production of 5 Mmcf/d. While the location of this spectacular vertical well was not provided, the same company update noted that Atlas had completed over 100 vertical wells in its Marcellus drilling program.

Laurel Mountain Midstream LLC joint venture

In April, 2009 APL announced that it had become 49% owner of a joint venture with The Williams Companies in which substantially all of its Appalachian pipeline gathering system had been transferred to it.

Drilling program unfolds in 2009

Atlas was reported to be actively leasing drilling rights in Fayette, Greene, Washington and Westmoreland Counties in Pennsylvania.

Atlas' second quarter, 2009 report stated that the company had drilled 19 vertical and two horizontal wells in the quarter. It had completed one of the two horizontal ones.

The company planned to drill and complete roughly 100 vertical and 4 horizontal Marcellus shale wells before the end of 2009. The horizontal wells were to be 100% owned by Atlas.

According to a July, 2009 report, Atlas had about 75 people working in its Moon Township Headquarters and another 200 in its Fayette County Field Office in Smithfield, PA.

Horizontal drilling starts to pay off

In November, 2009 Atlas reported that it had drilled two horizontal wells in southwestern Pennsylvania:

- one in western Fayette County - 3.3 million Mmcf/d average for 30 days

- another in eastern Greene County - 3.5 million Mmcf/d average.

The first well had shown virtually no decline after 40 days, and the second Greene Co. one had shown similar stable or flat performance. During the first 3 quarters of 2009, the company had drilled 14 horizontal wells. 4 were online and producing, whereas of the remaining 10 wells one was flowing but awaiting connection, three were shut-in behind a processing plant upgrade, and six were awaiting fracs. These are to be placed online during the final quarter of 2009 or in 2010. Some of these wells are in the company's partnership program or else were drilled in partnership with other companies and are not owed outright. However, in 2010, Atlas planned to drill and complete 30 horizontal Marcellus shale wells on its own account.

Atlas' metamorphosis into a full E & P company

A year-end 2009 Atlas update in late February, 2010 emphasized that the company had been undergoing a transformation from a master partnership that maximized cash distributions to limited partners to that of a more full E & P company with a specific focus on the Marcellus and other shale formations. The shifting emphasis had involved organizational and staff changes as well as general curtailment of shallow drilling activities. At the time of this report, Marcellus production amounted to 60 Mmcf/d (gross) and 15 Mmcf/d (net) and this volume was on the increase.

2010 Timeline

The company continued to upgrade its pipeline and gas processing capacity to accommodate the future growth in production expected. It planned to drill 28 Marcellus wells that were 100% owened during 2010. All of its wells during 2009 had been drilled with limited partners.

New drilling strategy

The February, 2010 update also mentioned that Atlas had been using a drilling strategy of landing wells in the lower portion of the Marcellus formation in order to maximize exposure of fracs to the rich deposits of organic material that have highest productivity. By landing low, fracs were allowed to climb upwards into the part of the formation with best pay. According to Atlas' microseismic survey, the best intervals to frac are in the Anadarko limestone just below the Marcellus shale formation and in the Tully limestone that sits above the Hamilton group--right above the Marcellus formation. The company's microseismic logs indicated that its wells were draining a 350 foot section that was about evenly divided between the Hamilton group and the Marcellus shale. The company was estimating that the fully loaded cost of drilling a well at approximately $4.2 million, although it was experiencing improved economics through an experience factor and cost was expected to decline to $3.75 million through:

- greater use of pad drilling

- more specifically targeted completions

- greater reuse (100%) of waste water

Reliance Industries joint venture

Map courtesy of Atlas Energy

A joint venture was announced in April, 2010 between Atlas and an Indian energy company, Reliance Industries Limited (RIL) through its subsidiary, Reliance Marcellus LLC. The latter company acquired 120,000 acres of Atlas' Marcellus acreage mainly in southwestern Pennsylvania. It represented a 40% stake in Atlas' undeveloped leasehold. The deal involved a total of $1.7 billion. $340 million was to be paid up front with a carry of $1.36 billion representing 75% of Atlas' costs for developing its prospective holdings. The carry was to be met within 5 1/2 years with the possibility of renewing for two additional years under certain conditions. Atlas was to be development operator. The JV had the following 5-year drilling plans:

* 45 horizontal wells for the balance of 2010 * 108 wells in 2011 * 178 wells in 2012 * 300 wells in 2013 * 300 wells in 2014

Atlas controlled 280,000 additional Appalachian acres not covered by the JV, but should it decide to sell any of this acreage, Reliance retained a right of first refusal to purchase it at $8,000/acre or less. Most of this acreage is in Mercer and Crawford counties among others.

Reliance JV picks up more acreage

At the end of April, 2010 it was announced that the Atlas - Reliance JV was to purchase an additional 42,344 acres of Marcellus shale primarily located in Armstrong, Clarion, Fayette, Indiana, Washington, and Westmoreland counties. It had cost the JV an average of $4,532 per acre. This increased the acreage controlled by it to 343,000 acres--206,000 of these were net to Atlas. The JV had closed on April 21, 2010.

Westmoreland Co. drilling

In June, 2010, Atlas was reported planning to drill a Marcellus shale well off of Hahntown-Wendel Road in North Huntingdon, Westmoreland County, east of Pittsburgh during the summer of 2010. The well was to be spud on a 9.5 acre parcel in a residential area in the vicininty of Barnes Lake Road.

Production rises

Net Marcellus shale gas production rose from 20.2 Mmcfe per day by the end of March, 2010 to 33.2 Mmcfe per day at the end of June, 2010, representing a 64% increase. Overall production had been up 10%. During the 2nd. quarter, Atlas had turned 8 horizontal wells into line with average peak production rates above 5.1 Mmcfe/d. The company attributed its good results in part to landing wells in the deeper sections of the Marcellus shale which have been more productive in the company's experience.

Fayette Co. drilling

The company was reported in July, 2010 applying to drill a Marcellus shale well on land belonging to the Connellsville Sportsmen's Association Inc. in Bullskin Township, Fayette County, PA. The well required zoning approval from the county hearing board, and the company was being asked to have safety experts testify on its behalf.

Enters Utica/Collingwood Shale play

Atlas also has a 115,000 gross acre leasehold (70,000 net) in Michigan's emerging Utica/Collingwood Shale play, 83% held by production. The company had acquired 15,000 acres in this play during the first quarter of 2010 for roughly $321/acre. The company planned to drill several wells on this acreage.

Spotlight Issues

- Prior to its acquisition, Atlas was trending positively in its Marcellus development gaining experience and enjoying decreasing costs.

- As of January, 2011 it is unclear whether Chevron will operate Atlas as a separate corporate entity or else fold it into its own organizational structure.

Executive Contacts

- Richard D. Weber is President and COO of Atlas Energy.

- Edward E. Cohen, Ph.D. is CEO of the company.

- Matthew A. Jones is the CFO.

- Jeff Kupfer is a Senior Vice President of Atlas.

- Greg Ryan is Senior Vice President of Land.

- Greg Muse is Senior Vice President of Marcellus Operations.

- Tommy L. Thompson is Vice President, Horizontal Drilling.

- Brian Begley is Vice President of Investor Relations.

- Gene Dubay is President and CEO of Atlas Pipeline Partners.

- Brett Loflin is Director of Permitting and Regulatory

Compliance.

- Tim Svarczkopf is Director of Water Management.

- Jim Brauns is an Environmental Regulatory Compliance Officer.

- Bob Hertz and Brett Loflin are spokesmen for Atlas.

- Greg Hild is a Chevron Corp. geologist.

Categories: E&P Companies | Active | Regional | Pennsylvania | Northeastern PA | Southwestern PA | Allegheny County | Armstrong County | Clarion County | Indiana County | Greene County | Washington County | Westmoreland County | Marcellus shale | Fayette County | 500,000 to 1 million acres | Utica shale | Michigan | Divested All Interest